Need To Speak To Lance The PI?

Talk to Private Investigator Lance Casey by clicking one of the options below.

Private Call/Text:

(916) 312-3185

1099 Form Independent Contractor

Which 1099 form is for independent contractors?

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

What is the difference between 1099 and independent contractor?

The employer withholds income taxes from the employee’s paycheck and has a significant degree of control over the employee’s work.

What is difference between 1099-MISC and 1099-NEC?

Form 1099-MISC differs from Form 1099-NEC in one distinct way. A business will only use a Form 1099-NEC if it is reporting nonemployee compensation. If a business needs to report other income, such as rents, royalties, prizes, or awards paid to third parties, it will use Form 1099-MISC.

How do I fill out a 1099 for a contractor?

What’s the difference between a Form W-2 and a Form 1099-MISC or Form 1099-NEC?

Although these forms are called information returns, they serve different functions.

Employers use Form W-2, Wage and Tax Statement to:

Report wages, tips, and other compensation paid to an employee.

Report the employee’s income and social security taxes withheld and other information.

Employers furnish the Form W-2 to the employee and the Social Security Administration. The Social Security Administration shares the information with the Internal Revenue Service.

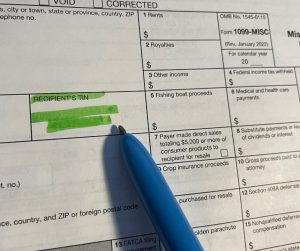

Payers use Form 1099-MISC, Miscellaneous Income or Form 1099-NEC, Nonemployee Compensation to:

Report payments made of at least $600 in the course of a trade or business to a person who’s not an employee for services (Form 1099-NEC).

Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099-MISC).

Report payment information to the IRS and the person or business that received the payment.

Dealing with Contractors or Vendors Refusing to Provide a W-9 for a 1099

Dealing with Contractors or Vendors Refusing to Provide a W-9 for a 1099: A Comprehensive Guide In the realm of business and finance, navigating the complexities of tax compliance is

How To Get A Wage Garnishment for an Employee of Fidelity National Title Company in Roseville CA

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on reddit Reddit Share on telegram Telegram California Private Investigator Lance Casey is

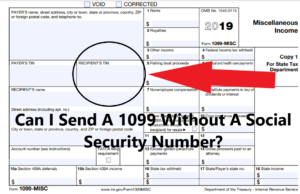

Can I Send A 1099 Without A Social Security Number

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Do You Need Social Security Number For 1099? My name is Lance Casey and I am a private

How Do You Get Someone’s Social Security Number If The TurboTax 1099-MISC Form Generator Won’t Allow You To Leave The SSN Box Empty?

Do You Need To Get Someone’s Social Security Number? As long as you have a permissible purpose to get someone’s SSN, all we will need is their full name, age